Do you work in any profession from Maharashtra? Then you must pay professional tax to the Maharastra Government to keep your profession current.

The Maharashtra Goods and Services Tax (Mahagst) website provides a convenient online platform for taxpayers to download PTRC challan forms and make payments without any hassle. This piece of content will provide you with an extensive guide on how to download PTRC challan from mahagst site.

Table of Contents

What is PTRC Challan?

Before we dive into how to download PTRC challan from mahagst site, let us understand what it is. A PTRC challan is a form used for depositing Professional Tax with the state government. If you are a doctor, engineer, lawyer, self-employed, or running any business in Maharashtra, you will be required to pay Professional Tax to the Government of Maharashtra. The state government imposes Professional Tax and the amount of tax may be different for each state.

How to Download PTRC Challan in 2023?

Individuals who earn a specific income threshold are subject to paying Professional Taxes. We know that a professional working in Maharashtra is required to pay the Professional Tax and the PTRC challan is a form that is used to pay the tax. If you don’t know how to download PTRC challan from mahagst site then keep reading this article till the end, you will not be required to visit any other blog to understand the process of downloading the PTRC challan. Because here we have presented you with a detailed guide on how to download PTRC challan so that you can complete the process without any confusion.

To download your PTRC challan from mahagst website, follow the steps mentioned below:

- Open the Maharashtra Goods and Services Tax (mahagst) website in a browser. Click Here to visit the mahagst website.

- Then click on the “E-service login” tab that is located at the middle of the home page.

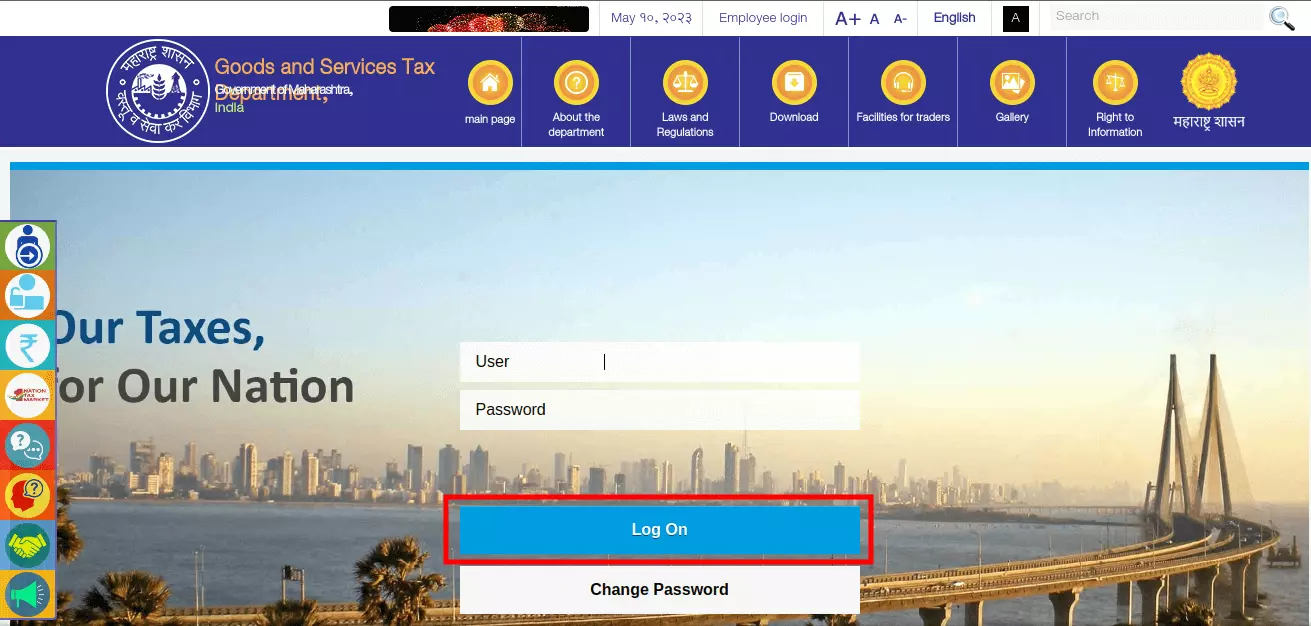

After clicking on the “E-service login” tab, a new prompt will appear asking you to fill up your username and password, simply fill up the details and click on “Log On” button.

- Choose the “e-Services” option, and a new page will appear. From there, click on the “Profession Tax” option.

- Once you click on the “Profession Tax” tab, a new page will open up displaying various options. Among them, you have to choose the “e-Payment” option.

- Once you click on the “e-Payment” option, a prompt will appear asking you to choose the payment type. From the list, you have to select the “PTRC” option.

- Following that, you will be directed to a new page where you need to furnish some details. In the respective fields, you must enter your PAN and TAN numbers. Moreover, you will need to choose the Assessment Year from the drop-down menu.

- By filling the captcha code click on the “Submit” button to move one step forward.

- Once you have clicked on the “Submit” button, you will be able to download and take a printout of the PTRC challan.

- Once you download the PTRC challan, you have to pay it at an authorized bank. To avoid any penalties, it is crucial to make the payment before the due date.

By following the steps mentioned above you can download your PTRC challan within a couple of minutes from the Maharashtra Goods and Services Tax (mahagst) website.

Conclusion

Paying your Professional Tax is an important obligation that applies to self-employed and working professionals in Maharashtra. The mahagst website makes it easy for you to download the PTRC challan and make your payment. By following this comprehensive guide on how to download PTRC challan, you can save a lot of time and download your PTRC challan from the mahagst website and make your payment quickly and easily.

FAQs

1. What if I enter incorrect details while generating the challan?

Ans: If you enter incorrect details while generating the challan, you will need to start the process again with the correct details. It is important to ensure that all the details you enter are accurate to avoid any issues in the future.

2. What is Professional Tax (PT)?

Ans: PT (Professional Tax) is a tax imposed by the state government on individuals and companies, which is determined by their earnings.

3. Who is required to pay PT in Maharashtra?

Ans: The Government of Maharashtra mandates that every self-employed professional and business entity must pay Professional Tax.

4. Can the PTRC payment be made offline?

Ans: Yes, you can make the PTRC payment offline.

5. What is the penalty for non-payment of PTRC in Maharashtra?

Ans: Non-payment of PTRC in Maharashtra attracts a late payment penalty of 1.25% per month or part of the month, and an interest penalty of 1.5% per month or part of the month. If the default continues, legal action may be initiated, leading to fines, penalties, or imprisonment. Timely payment is mandatory.

6. Is Income Tax and Professional Tax the same?

Ans: Not the same. Income tax is a tax levied by the central government on income earned by individuals, while professional tax is a state-level tax levied on income earned by professionals such as doctors, lawyers, self-employed professionals, and engineers. The payable income tax amount is determined by the individual’s earnings, whereas the payable professional tax amount varies according to the state of employment.